Platform Overview

SquareOffBots (www.squareoffbots.com) is a Do-It-Yourself (DIY)

automation platform for options trading with the following key

features:

-

Automated Trading: Create and execute custom

option trading strategies automatically

-

Cost-Free Access: Unlimited strategy creation and

order execution at no cost for referral users

-

Broker Integration: Seamlessly works with Dhan

and AliceBlue brokers

-

Strategy Flexibility: Build custom strategies or

use pre-defined templates

-

Real-time Execution: Automated order placement

and risk management

-

User-Friendly: Simple interface for both

beginners and experienced traders

User Onboarding Process

Getting started with SquareOffBots is simple and straightforward.

Here's everything you need to know:

-

Supported Brokers:

- Dhan - Full integration with all platform features

- AliceBlue - Complete API support for automated trading

-

Trial Period:

- 14-day free access to explore all platform features

- No credit card required during trial period

- Full access to strategy creation and testing

-

Referral Benefits:

- Lifetime free access through broker referral program

- Unlimited strategy creation and execution

- Priority support for referred users

-

Account Security:

- Daily login required for strategy activation

- No user data is stored on our servers

Note: Make sure to complete your broker account

setup before starting the platform integration.

Strategy Templates

Choose from our pre-built strategy templates to quickly get started:

-

Basic Templates:

- STRADDLE - ATM Call & Put options

- STRANGLE - OTM Call & Put options

- IRON CONDOR - Credit spread combination

- SYNTHETIC FUTURE

-

Advanced Templates:

-

BASKETS - Short Strangles with Hedge Shorted in Morning and

Evening Batches

-

Custom Templates:

-

Any strategy a user creates, can be used as Template for

modifying and building new strategies

Strategy Naming

Guidelines for naming your strategies:

- All strategy names should be Alphanumeric

- Strategy names are Case Insensitive

-

You cannot use names of Platform Templates as Strategy Names

-

When a new strategy is saved with an existing strategy name,

existing strategy will be replaced

Strategy Level M2M Stoploss

You can set a M2M Stoploss for your strategy to exit when the overall strategy PNL reaches a set level:

-

Absolute:

-

This is Rupee level setting, it will exit the strategy when the overall strategy PNL goes below this level.

Example: If you set Rs.10,000/- as absolute Stoploss of this strategy. No matter how many lots you trade with, the strategy will exit, if the loss hits Rs.10,000/-

Note: This does not scale with number of lots you trade with.

-

CombinedPremium:

-

This is points level stoploss setting. If your strategy's loss goes below this level, the strategy will exit.

Example: If you set 100 points as CombinedPremium Stoploss of this strategy. Underlying is Nifty, then per lot stoploss is 100×75 = Rs.7,500/-

Note: This scales with number of lots you trade with.

-

CombinedPremium%:

-

This is percentage level stoploss setting.

Example: If you set 25% as CombinedPremium% Stoploss of this strategy. And you are trading a short-straddle strategy with only CE and PE legs:

• If CE executed price is Rs.100/- and PE executed price is Rs.200/-

• Then strategy will exit, if the combined premium reaches (200+100)×25% = Rs.75/-

• So strategy exits at 75 points loss

Note: This scales with number of lots you trade with.

Strategy Level M2M Target

You can set a M2M Target for your strategy to exit when the overall strategy PNL reaches a set level:

-

Absolute:

-

This is Rupee level setting, it will exit the strategy when the overall strategy PNL goes above this level.

-

For example : If you set Rs.10,000/- as absolute Target of this strategy. No matter how many lots you trade with, the strategy

will exit, if the profit hits Rs.10,000/-

-

Note :: This does not scale with number of lots you trade with.

-

CombinedPremium:

-

This is points level target setting. If your strategy's profit goes above this level, the strategy will exit.

For example : If you set 100 points as CombinedPremium Target of this strategy. Underlying is Nifty, then per lot target is 100*75 = Rs.7,500/-

Note :: This scales with number of lots you trade with.

-

CombinedPremium%:

-

This is percentage level target setting.

-

For example : If you set 25% as CombinedPremium% Target of this strategy. And you are trading a short-straddle strategy. with only CE and PE legs

if CE executed price is Rs.100/- and PE executed price is Rs.200/-

Then strategy will exit, if the combined premium Reaches (200+100)*25% = Rs.75/- . So strategy exits at 75 points profit

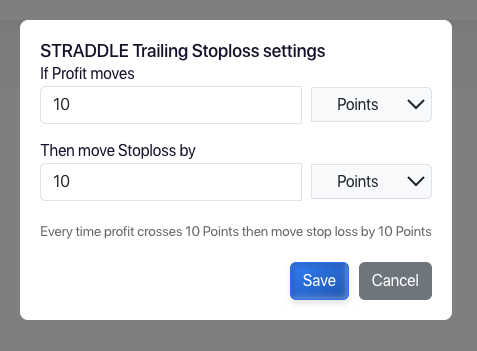

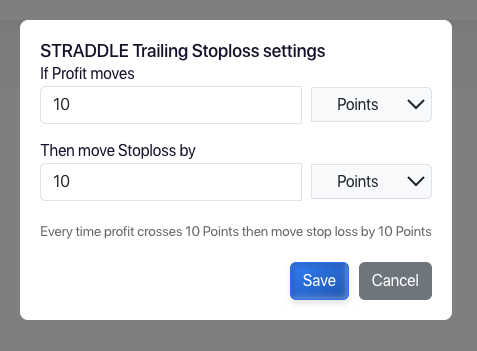

Strategy Level Trailing Stoploss

Strategy Stoploss level can be trailed when the strategy Profit(/m2m) increases , you can set how much the stoploss level should be trailed for an increase in the profit level

Stoploss can be trailed as :

1. Absolute

2. Points

3. CombinedPremium%

example 1 : you can set 10 points as stoploss Trail, for every 10 points move in profit

example 2 : you can also combine the pnl types and set 10 points as stoploss Trail, for every 1000Rs. in profit

note : when Absolute is Selected, it remains fixed for the strategy, it does not scale with the number of lots you trade with.

if you set Rs.1000/- Absolute as Trailing stoploss, whether you trade with 1 lot or 10 lots, the stoploss will trail only by Rs.1000/-

Strategy Level Momentum Entry (Waits to Trade)

The strategy will wait for the underlying (/spot) to move a set percentage after the strategy start time, and then execute

Underlying movement can be set as :

-

Percentage:

-

Waits for the underlying (/spot) to move a set percentage after the strategy start time, and then execute

-

Points:

-

Waits for the underlying (/spot) to move a set points after the strategy start time, and then execute

-

Up (Direction):

-

Only Upward movement of the underlying (/spot) will be considered for execution

-

Down (Direction):

-

Only Downward movement of the Spot will be considered for execution

-

Any (Direction):

-

Any movement of the Spot will be considered for execution

Strategy Level Momentum Exit

The strategy will exit when the underlying (/spot) moves after the strategy start time.

Underlying movement can be set as :

-

Percentage:

-

Exits when the underlying (/spot) moves a set percentage after the strategy start time

-

Points:

-

Exits when the underlying (/spot) moves a set points after the strategy start time

-

Up (Direction):

-

Only Upward movement of the underlying (/spot) will be considered for exit

-

Down (Direction):

-

Only Downward movement of the underlying (/spot) will be considered for exit

-

Any (Direction):

-

Any movement of the underlying (/spot) will be considered for exit

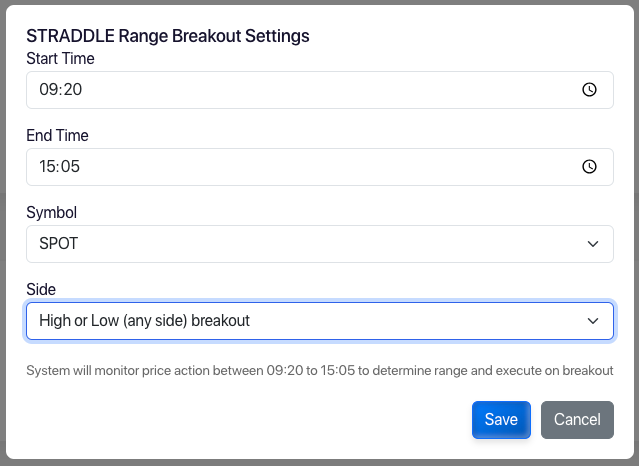

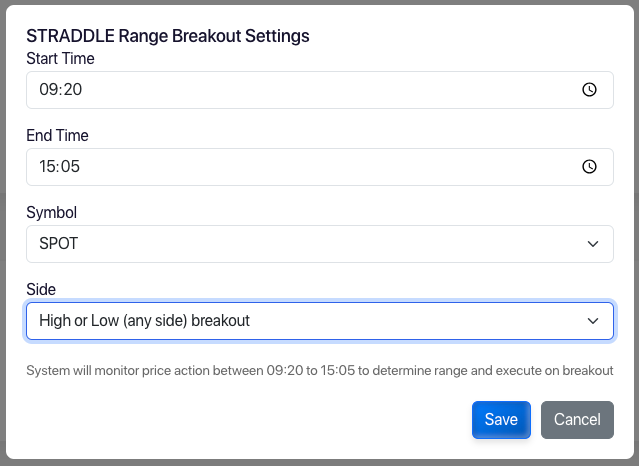

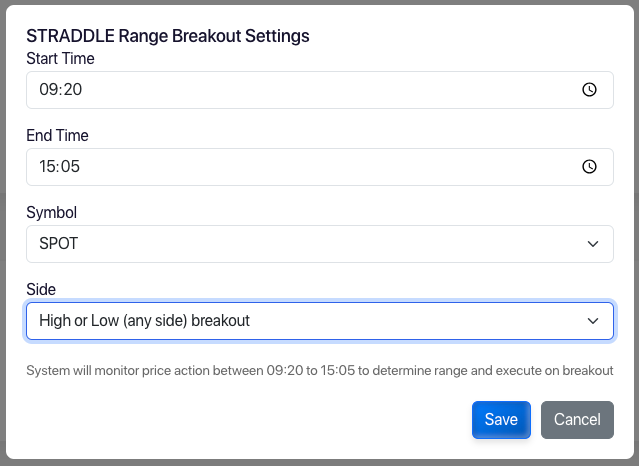

Strategy Level Range Breakout (Waits to Trade)

The strategy will enter the market when the underlying (/spot) breaks out of a given range.

You can specify a time range to consider for the breakout. The time range will be of the current day

-

Time Range:

-

If you set 9:15 AM to 9:30 AM as Time Range, then the strategy will enter the market when the underlying (/spot) breaks out of the range between 9:15 AM and 9:30 AM of the current day.

-

If you set 9:15 AM to 9:30 AM as Time Range, but your strategy start time is 9:20 AM, then the strategy will wait till the Range if formed, and then monitor for the breakout.

-

Side:

-

You can specify Range-High or Range-Low or both.

ex :if Range-High is selected, then the strategy will enter the market when the underlying (/spot) > High of the Range

Strategy Level Re-execution

This closes all the current legs and restarts the strategy

You can set the number of times the strategy will be re-executed.

Strategy Level Re-execution Conditions :

-

Underlying Movement (/momentum):

-

Strategy Re-executes, if spot moves a certain number of points or percentage after the strategy start time

-

Target Hit:

-

Strategy Re-executes, if the Strategy M2M Target is hit

-

Stoploss Hit:

-

Strategy Re-executes, if the Strategy M2M Stoploss is hit

Strategy Timing Settings

Configure the timing parameters for your strategy:

-

Start Time:

-

Start time of a strategy can be valid market hours in HH:MM between

9:15 and 15:05

- Strategy Start time by default is 9:15 AM

- Strategy time can be any time after 9:15 AM

-

End Time:

- End time of a strategy can be valid market hours in HH:MM

- End Start time by default is 15:05 PM

-

Strategy End time should atleast be 5 mins after strategy start

time

Leg Timing Settings

Configure the timing parameters for your strategy leg:

-

Start Time:

-

Start time of a leg can be valid market hours in HH:MM between

9:15 and 15:05

- Leg Start time by default is Strategy Start time

- Leg time can be any time after the strategy start time

-

End Time:

- End time of a leg can be valid market hours in HH:MM

- End Start time by default is Strategy End time

-

Leg End time should atleast be 5 mins after strategy start

time

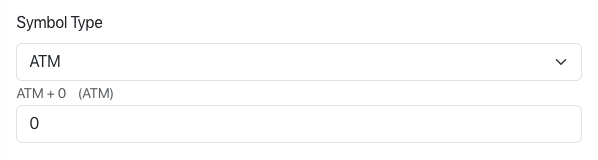

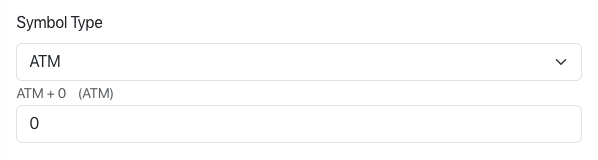

Symbol Selection

Symbol can be selected as :

-

ATM

When symbol type is chosen as 'ATM', you can select the nth OTM/ITM option.

example :

If value is 0 ATM option will be selected.

If value is 1, 1st OTM option will be selected.

If value is -1, 1st ITM option will be selected.

The ATM level will be computed at leg start time.

If a wait and trade option such as range-breakout/momentum-entry is selected, then the ATM level will be computed after the wait and trade condition is met.

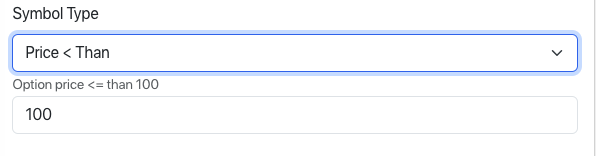

-

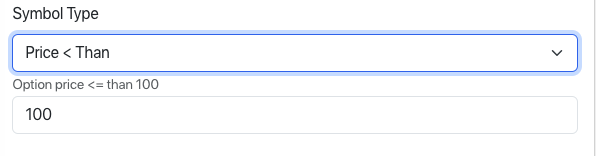

Price < Than

Option with the price nearest to and less than the given price will be selected.

-

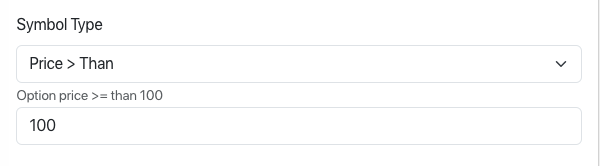

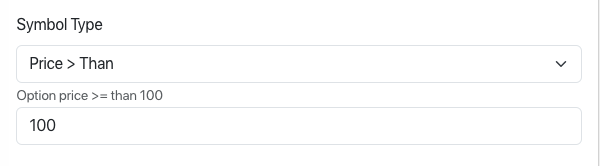

Price > Than

Option with the price nearest to and greater than the given price will be selected.

-

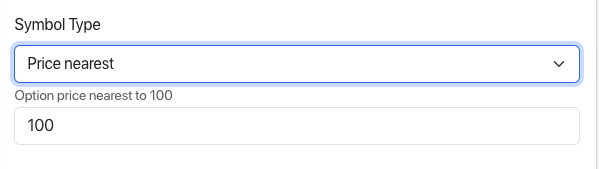

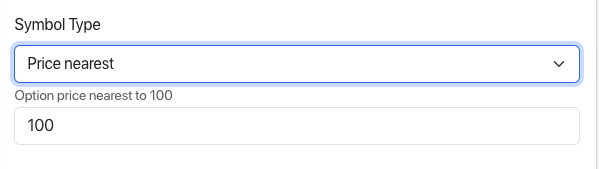

Price Nearest

Option with the price nearest to the given price will be selected. This can be either less than or greater than the given price.

-

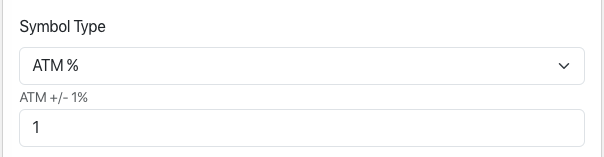

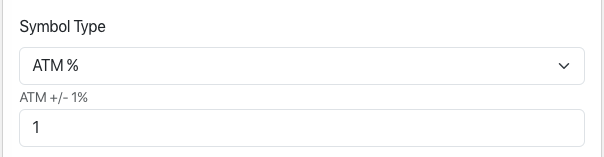

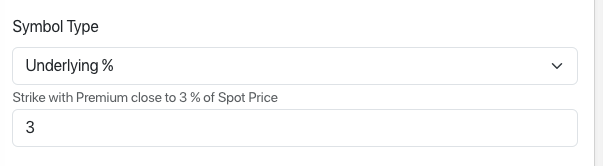

ATM Percentage

If ATM strike is 25200 at the start time of the leg;

If you set 1% as ATM Percentage, then the option with strike price 25200 + 1% = 25450 will be selected.

If you set -1% as ATM Percentage, then the option with strike price 25200 - 1% = 24950 will be selected.

-

Straddle Width

This is Selection based on the Combined Premium of the ATM straddle.

If the combined premium of ATM straddle is 200 (ce_price =100, pe_price =100) .

Then if 0.5 is chosen as straddle width. 200*0.5 = 100 will be used as the distance from ATM strike to select the option.

If the ATM strike is 25200, then the option with strike price 25200 + 100 = 25300 will be selected.

-

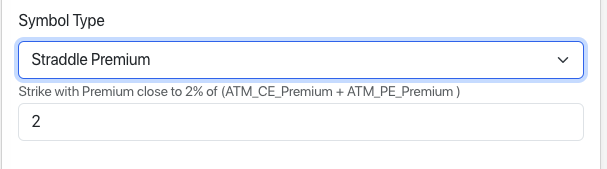

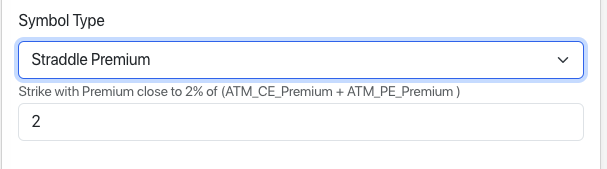

Straddle Premium

This is Selection based on the Combined Premium of the ATM straddle.

If the combined premium of ATM straddle is 200 (ce_price =100, pe_price =100) .

Then if 50 is chosen as straddle premium percentage. 200*0.5 = 100 should be the price of the option. Option with price nearest to 100 will be selected.

-

Spot %

If the current spot price is Rs.25,149/- ; and 1% is chosen as Underlying % option with premium closest to this value will be selected.

25149*1/100 = 251.5 ; Option price nearest to 251.5 will be selected.

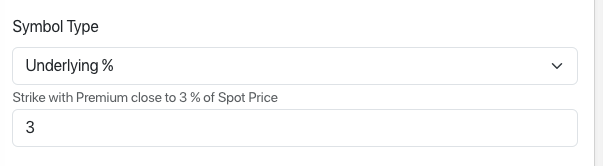

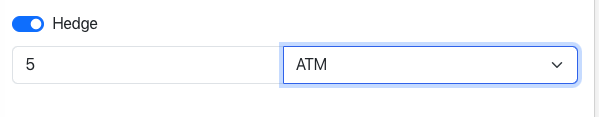

Hedge Selection

A hedge order will be placed before the entry order is placed.

Hedge can be selected based on Price or OTM level.

if 5 is chosen as OTM level, then strike for the hedge order will be 25200 + 5*50 = 25450 for NIFTY

if 5 is chosen as price level, then option with price nearest to Rs. 5/- will be selected.

The entry order will be placed only after the hedge order is completely executed.

If a hedge order fails, the entry order will not be placed.

At the time of exit the entry order is first exited and then the hedge order is exited.

The hedge order is placed and exited along with the entry order.

SL 2 COST

-

For a leg which has stoploss, a SL2 COST condition can be added

based on any other leg in the strategy

When the sl2cost leg hits stoploss or target, the current legs stoploss order's trigger price will be changed to the entry order's average price.

A list of eligible legs which can be used for sl2cost will be shown in the dropdown

-

The leg which is chosen as sl2cost leg, should have a starttime which is same or earlier to the current leg. And end time which is same or later to the current leg.

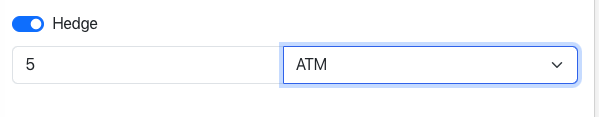

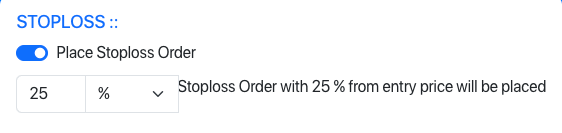

Stoploss Order

A stoploss order can be added to a leg. It can be chosen as % or points from the entry order's average price.

Example 1 (Percentage):

A Sell Entry order's average price is 250

If 25% is chosen as stoploss, then the stoploss order will be placed at:

250 + 250×0.25 = 312.5 for the same symbol

Example 2 (Points):

If 100 points is chosen as stoploss, then the stoploss order will be placed at:

250 + 100 = 350 for the same symbol

Usually a leg with stoploss order is exited by filling the stoploss order, (and not by cancelling the stoploss order and placing an exit order)

Leg Level M2M Stoploss

You can set a M2M Stoploss for your leg to exit when the overall leg PNL reaches a set level:

-

Absolute:

-

This is Rupee level setting, it will exit the leg when the overall leg PNL goes below this level.

Example: If you set Rs.1000/- as absolute Stoploss of this leg. No matter how many lots you trade with, the leg will exit, if the loss hits Rs.1000/-

Note: This does not scale with number of lots you trade with.

-

Premium:

-

This is points level stoploss setting. If your leg's loss goes below this level, the leg will exit.

Example: If you set 100 points as Premium Stoploss of this leg. Underlying is Nifty, then per lot stoploss is 100×75 = Rs.7,500/-

Note: This scales with number of lots you trade with.

-

Premium%:

-

This is percentage level stoploss setting.

Example: If you set 25% as Premium% Stoploss of this leg and executed price is Rs.100/-

Then leg will exit, if the premium reaches 100×25% = Rs.75/-

So leg exits at 75 points loss

Note: This scales with number of lots you trade with.

Leg Level M2M Target

You can set a M2M Target for your leg to exit when the overall leg PNL reaches a set level:

-

Absolute:

-

This is Rupee level setting, it will exit the leg when the overall leg PNL goes above this level.

For example : If you set Rs.1000/- as absolute Target of this leg. No matter how many lots you trade with, the leg

will exit, if the profit hits Rs.1000/-

Note :: This does not scale with number of lots you trade with.

-

Premium:

-

This is points level target setting. If your leg's profit goes above this level, the leg will exit.

For example : If you set 100 points as Premium Target of this leg. Underlying is Nifty, then per lot target is 100*75 = Rs.7,500/-

Note :: This scales with number of lots you trade with.

-

Premium%:

-

This is percentage level target setting.

For example : If you set 25% as Premium% Target of this leg.

if executed price is Rs.100/-

Then leg will exit, if the premium Reaches 100*25% = Rs.75/- . So leg exits at 75 points profit

Note :: This scales with number of lots you trade with.

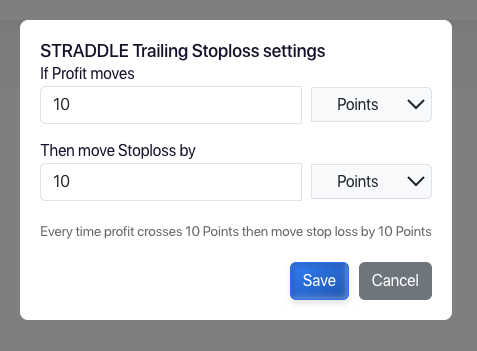

Leg Level Trailing Stoploss

Leg Stoploss level can be trailed when the leg Profit(/m2m) increases , you can set how much the stoploss level should be trailed for an increase in the profit level

Stoploss can be trailed as :

1. Absolute

2. Points

3. CombinedPremium%

example 1 : you can set 10 points as stoploss Trail, for every 10 points move in profit

example 2 : you can also combine the pnl types and set 10 points as stoploss Trail, for every 1000Rs. in profit

note : when Absolute is Selected, it remains fixed for the strategy, it does not scale with the number of lots you trade with.

if you set Rs.1000/- Absolute as Trailing stoploss, whether you trade with 1 lot or 10 lots, the stoploss will trail only by Rs.1000/-

Leg Level Momentum Entry (Waits to Trade)

The leg will wait for the underlying (/spot) to move a set percentage after the leg start time, and then execute

Underlying movement can be set as :

-

Percentage:

-

Waits for the underlying (/spot) to move a set percentage after the leg start time, and then execute

-

Points:

-

Waits for the underlying (/spot) to move a set points after the leg start time, and then execute

-

Up (Direction):

-

Only Upward movement of the underlying (/spot) will be considered for execution

-

Down (Direction):

-

Only Downward movement of the Spot will be considered for execution

-

Any (Direction):

-

Any movement of the Spot will be considered for execution

Leg Level Momentum Exit

The leg will exit when the underlying (/spot) moves after the leg start time.

Underlying movement can be set as :

-

Percentage:

-

Exits when the underlying (/spot) moves a set percentage after the leg start time

-

Points:

-

Exits when the underlying (/spot) moves a set points after the leg start time

-

Up (Direction):

-

Only Upward movement of the underlying (/spot) will be considered for exit

-

Down (Direction):

-

Only Downward movement of the underlying (/spot) will be considered for exit

-

Any (Direction):

-

Any movement of the underlying (/spot) will be considered for exit

Wait & Trade

After the leg start time, you can make the leg wait till an upward of downward movement has happened before execution

example:

if current spot is 25200; and you have chosen ATM+3 CE as the leg symbol; and given wait & trade value as 10 points ;

At the time of execution, the option chosen will be 25500CE ; but execution will not take place immediately.

It will wait till 25500CE's price moves 10 points down from the premium at leg start time.

Wait & Trade can be set as :

Percentage:

-

Waits for the chosen legs premium to move by the given %; negative values means down movement

Points:

-

Waits for the chosen legs premium to move by the given points; negative values means down movement

Range Breakout (Waits to Trade)

The leg will enter the market when the [underlying (/spot) or the given leg-symbol] breaks out of a given range.

You can specify a time range to consider for the breakout. The time range will be of the current day

-

Symbol:

-

Range of either the underlying (/spot) or the given leg-symbol (computed at the starttime of the leg) can be considered for the breakout.

-

Time Range:

-

If you set 9:15 AM to 9:30 AM as Time Range, then the strategy will enter the market when the underlying (/spot) breaks out of the range between 9:15 AM and 9:30 AM of the current day.

-

If you set 9:15 AM to 9:30 AM as Time Range, but your strategy start time is 9:20 AM, then the strategy will wait till the Range if formed, and then monitor for the breakout.

-

Side:

-

You can specify Range-High or Range-Low or both.

ex :if Range-High is selected, then the strategy will enter the market when the underlying (/spot) > High of the Range

Reentry

An exited leg can be again re-entered choosing this option

Re-entry can be chosen to be executed only on

i) Stoploss hit

ii) Target hit

iii) Either stoploss or target hit

You can choose the re-entry to happen any number of times.

There are 3 kinds of re-entry :

-

Re-cost: (Waits)

-

After a leg hits stoploss. it waits for the leg-symbol to move back to the entry price of the leg, and then the leg is executed again. With the same symbol.

For example :

If you have shorted an option and your leg entry price is Rs.100/- and stoploss is 50%; then when symbol price crosses 150; your stoploss is hit and the leg exits.....but waits for the price to fall back to 100/- and then re-enters the market.

Reexecute: (Immediately Executes on SL or Target hit)

-

If the spot is 25200; and ATM CE price is 150; you are short ATM CE and you have chosen 100% stoploss for this leg. (i.e leg exits when 25200 CE crosses 300Rs.)

When the leg hits stoploss. The spot would have moved to 25500. so now the new ATM CE is 25500 CE.

Now Re-execution on stoploss was chosen. A new leg will be placed with the new ATM CE. i.e 25500 CE.

Reentry: (Immediately Executes on SL or Target hit)

-

After a leg hits stoploss/Target. It immediately enters the market with the same symbol. Even if there was considerable market movement. The same initial symbol will be chosen.

Example :

If the spot is 25200; and ATM CE price is 150; you are short ATM CE and you have chosen 100% stoploss for this leg. (i.e leg exits when 25200 CE crosses 300Rs.)

When the leg hits stoploss. The spot would have moved to 25500. so now the new ATM CE is 25500 CE. But new leg execution will be still 25200 CE

Now Re-eentry on stoploss was chosen. A new leg will be placed with the same symbol as the original leg. i.e 25200 CE. and not 25500 CE